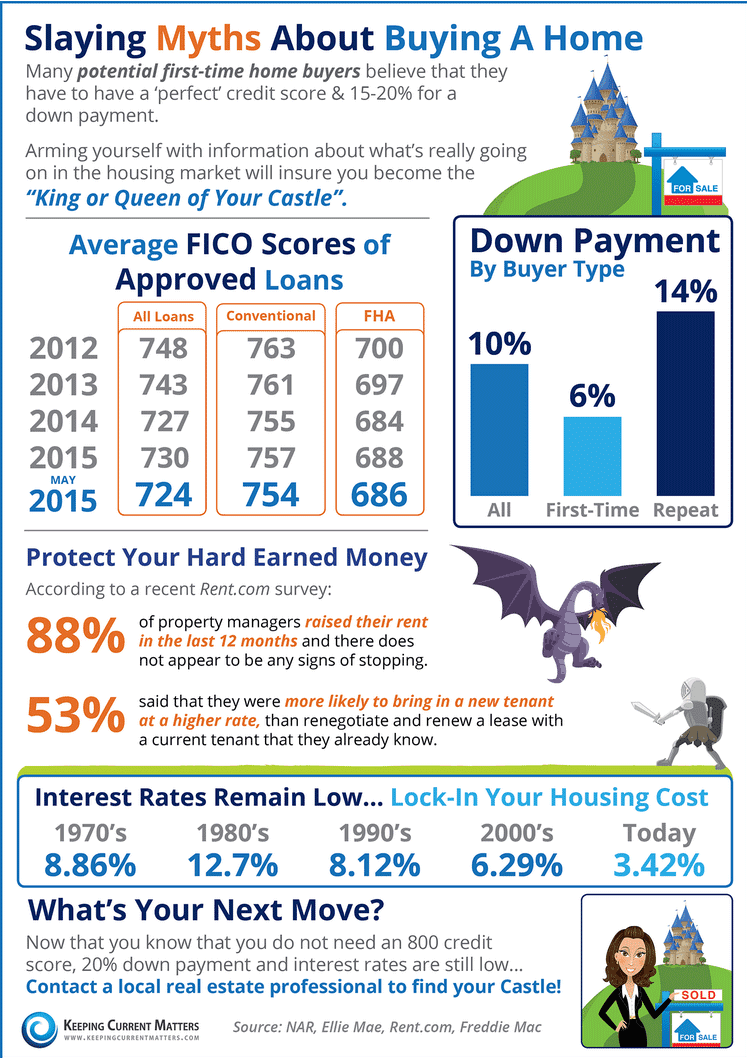

I was talking to someone in the grocery store checkout line recently, and mentioned that I was a Realtor. They replied “Oh, we’d love to buy a house, but I don’t think my credit score is high enough.” Unsurprisingly, a lot of potential buyers feel this way, or worry that they don’t have enough money for a down payment. So many of us have heard for so long that you need to put at least 10% down and have a credit score of 750 to qualify for any type of loan.Luckily for my grocery line companion, that’s not the case anymore. Check out the great graph below that outlines average credit scores for different types of loans, average down payments, and the trend interest rates have taken through the decades. Call or email if you have any questions!

Ready to Find Your Dream Home?

We’re here to listen to what’s most important to you and deliver top of the line service, expertise and advice that’s custom fit for you.

The three tree logo represents a listing courtesy of NWMLS.

Pending

Listing courtesy of Windermere Prof Partners

The three tree logo represents a listing courtesy of NWMLS.

Pending

Listing courtesy of Windermere Prof Partners

Windermere Professional Partners

Windermere Professional Partners